4) Set up exit positions

The step-by-step tutorial to get started with Crypto Excel.

Here is the best advice for succeeding in your investments and achieving the desired capital gains: define a clear strategy in advance.

When should you take profits?

When should you cut losses?

If you have done this work beforehand, as soon as you purchase your assets, you will be able to easily execute your strategy. On the other hand, if the market is volatile and prey to emotional swings, you will not be able to make the right decisions.

I) Manual strategy for the portfolio

In the bottom left-hand corner of your dashboard, you can set up two exit tresholds that apply to your entire portfolio.

Stop-Loss (SL), i.e. a loss threshold.

Take-Profit (TP), i.e. a profit threshold.

Double-click or press the “F” key to display the video in full screen.

In the following three scenarios, the value of our portfolio is €573.

“STRATEGY IS OK” scenario

Stop-Loss €500 – Take-Profit €1000

Your portfolio is currently between the two thresholds.

You do not need to take any action, hence the green light below.

“TAKE PROFITS” scenario

Stop-Loss €500 – Take-Profit €550

The value of your portfolio exceeds the Take-Profit threshold.

In this case, the indicator turns red, prompting you to take your profits.

“CUT LOSSES” scenario

Stop-Loss €600 – Take-Profit €1000

This time, the value of your portfolio is below the Stop-Loss threshold.

The indicator, which is also red, tells you to cut your positions in order to limit your losses.

Setting these exit targets for your portfolio has several advantages:

You can see the action to be taken at a glance, even before refining your analysis or making specific decisions for each of the cryptocurrencies you hold.

As most cryptocurrencies are correlated with each other, a change in the indicator status quickly alerts you to a reversal in market trends and allows you to react quickly.

II) Manual strategy for a cryptocurrency

Except in special cases, your portfolio consists of several cryptocurrencies.

Each line represents an asset you hold.

Another way of looking at it is that you have several positions open at the same time, positions that you hope will be profitable.

Unlike the previous section, you can configure:

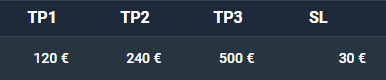

up to 3 Take-Profit thresholds: TP1, TP2, and TP3

This allows you to secure your gains gradually, in stages, instead of closing your positions too early in a bull market. This approach naturally improves your profitability.

A Stop-Loss threshold: SL.

Add a strategy

Click the “Strategy” button to open the “Set up exit positions” pop-up window.

From the drop-down list, choose the relevant cryptocurrency.

For each TP1-2-3 / SL threshold, you have two fields to fill in:

Target price

Exit percentage

The capital to withdraw is calculated by multiplying the number of tokens held, the target price and the exit percentage.

Then click “Confirm”.

You do not have to fill in all 8 fields.

You can leave the TP1, TP2, and TP3 fields blank and only fill in the SL fields. Or vice versa.

If you only want to set one profit threshold, only fill in the two fields associated with TP1.

Comment (optional)

You can add personal notes for each cryptocurrency.

These comments will appear in the Portfolio section of your dashboard, when you hover over the name of the cryptocurrency on the relevant line.

Case study

In this example, you bought Solana at €60 and now want to define your exit strategy.

Double-click or press the “F” key to display the video in full screen.

TP1

Target price: €120

This means you expect your earnings to double before taking your first profit.

% exit: 10%

Crypto Excel automatically calculates the capital to be withdrawn when Solana reaches €120. The remaining capital (90%) continues to be invested in Solana.

TP2

Target price: €240 (x4)

This target price also refers to the ATH (“All Time High”), the record price reached by Solana.

% exit: 50%

As this is a very strong psychological price, you decide to sell 50% of your position at this point.

TP3

Target price: €480 (x8)

Let's assume that you are confident that Solana has a bright future ahead of it. In this case, you set a high target price, which the cryptocurrency will reach in the long term.

% exit: 95%

Although you are liquidating most of your position, this does not prevent you from buying back Solana later, for example after a correction during a bear market.

SL

Limit treshold: €30 (-50%)

If the market reverses and Solana loses more than 50% of its value compared to your purchase price, reaching €30, you choose to close the position.

% exit: 80%

As a precaution, you secure most of your invested capital by withdrawing 80% of your stake in order to limit further potential losses. The remaining 20% remains invested in case the market starts to rise again.

In your dashboard, under Portfolio, the TP1, TP2, TP3, and SL columns are filled in with the price targets that have just been set.

These limit orders can be configured directly on your trading platforms.

Your positions will then be automatically closed (provided, of course, that the assets are on the platform on which the order was configured).

Delete a strategy

In the “Set up exit positions” pop-up window, delete any values in the relevant fields.

Then click the button “Confirm”.

Which price objectives should you set?

At this stage, you may be wondering:

What if I don't know what target prices to set? 🤔

First of all, even if you follow crypto news closely, it's important to remember that no one can accurately predict the price of a cryptocurrency on a specific date.

If you have skills in graphical analysis, you can try to estimate a market top using several indicators and methods, such as:

Moving averages

Bollinger bands

Fibonacci trading

Fortunately, Crypto Excel is designed for both experienced and beginners investors.

In the next section (see 5) Generate automated positions), we will show you:

How to automatically generate exit positions.

Various examples of strategies, whether manual or automated.

Please feel free to ask questions if you need to. We will continue to expand this documentation based on your feedback.

Last updated